New Age Competition in I/DD – Technology & Capital Investment

Companies with advanced technology and massive amounts of capital are beginning to see financial and operational opportunity in the I/DD market. These organizations are changing the competitive environment for traditional provider organizations, requiring specialty organizations to think differently.

The healthcare market overall has garnered a lot of attention as an aging population, chronic disease, and core pressures has taken hold. More specifically, the I/DD delivery system has displayed various inefficiencies which serves a population of extensive, long-term needs that incurs high care costs.

Given these characteristics, the market is primed for consolidation amongst providers to increase bargaining power, reduce waste, and entice technology companies to develop innovative products that improves care.

Mergers & Acquisitions Drive Quality & Efficiencies

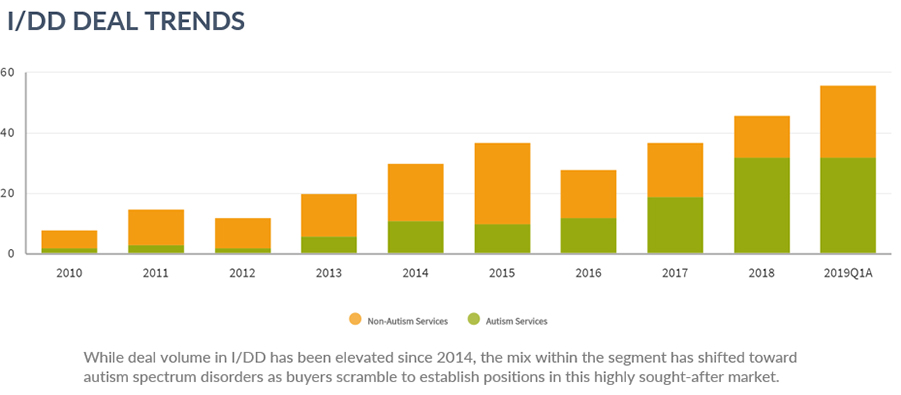

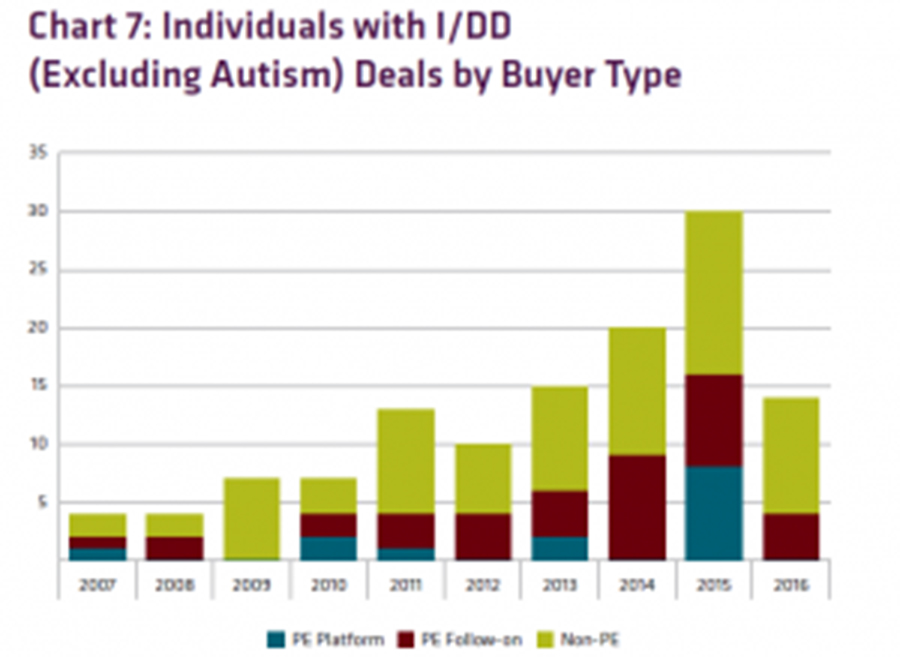

Mergers and acquisitions (M&A) across the entire healthcare space has increased over the last decade but until recently, the I/DD sector was paid scant attention. Until late 2014, transactions in the market were dominated by two primary buyers – ResCare and Mentor Holdings – but in 2015, private equity rushed to the I/DD market (Figure 1 and 2).

Figure 1. I/DD Deal Trends. The Braff Group.

https://thebraffgroup.com/market-sectors/behavioral-health/

Consolidation in I/DD has been attributed to market shifts in care delivery. There has been a marked trend towards service coordination, person-centered care, and reimbursement models focused on value-based payment methods. Further, health plans have been contracting to create narrow networks of providers.

Many non-profit and for-profit organizations are pursuing consolidation to create a competitive advantage. Organizations pursuing the M&A route see the decision as an opportunity to create efficiencies, increase bargaining power, and develop higher-quality supports.

Blue Sprig Pediatrics, Inc. is an autism services provider based out of Texas who has made M&A a core strategy for improving operations in applied behavioral analysis (ABA) therapy services (BlueSprig, 2019). They offer partnership through M&A to other ABA providers who are committed to quality and looking to grow in capacity. This strategy has extended their mission from Texas across the nation – now in eight states – TX, OH, SC, OK, AZ, OR, WA, KY. Their most recent acquisition was announced in June 2019 with the asset acquisition of Verbal Behavioral Consulting, a Kentucky-based provider of ABA services.

Investors with Capital Resources

M&A amongst provider organizations is not the only activity spurring competition. As previously mentioned, private equity has shown an increased interest in the I/DD space. And venture capital, too has been present, though to a lesser extent.

While both private equity (PE) and venture capital (VC) firms both raise pools of capital to invest in private companies there are a few differences between the two players.

- Private equity firms typically take a majority stake in mature companies, allocate capital to strategic growth, and strive to optimize financial performance.

- Venture capital firms typically fund and/or mentor startups or young companies with innovative or disruptive market approaches in exchange for a minor percentage of equity in the company.

Both types of firms are taking increasing interest in the I/DD space, providing new platforms for provider growth.

Private Equity

Private equity involvement in the I/DD space debuted in 2015, when eight PE firms sponsored over 30 deals in a single year, a 50% increase in sector deals than the previous high (Figure 2) (Braff, 2017).

Since the uptick, PE has been increasingly interested specifically in the autism space. Recent studies have shown the prevalence of ASD is high in the US, with 1 in 40 children being parent-reported with an ASD diagnosis (Kogan, et al., 2019) (Xu, et al., 2019). PE has begun backing existing providers with capital funds to expand their operations through partnerships and M&A with other provider organizations, invest in technologies to improve clinical care and patient experience, and grow team of trained clinicians to support the demand in services.

Major PE firms are now entering what has been a niche investment market. Earlier in August 2019, Morgan Stanley Expansion Capital fund provided funding to Alternative Behavior Strategies, a leading provider of services for children with ASD (ASB, 2019). PE firms that see clear leadership capabilities and competencies in providing care are excited to partner, leading to a strong capital resource for many providers.

Figure 2. Private Equity Deals in I/DD Market. The Braff Group. 2017.

marketWATCH: 2017 Behavioral Health – A Market In Flux.

Blue Wolf Capital Partners & RHA Health Services, LLC – On August 5, 2019, Blue Wolf Capital Partners, a New York-based private equity company acquired RHA Health Services, a large community-based health provider focused on I/DD, behavioral health, and substance abuse. Blue Wolf has created a health care investment portfolio centered around organizations that are “patient-centric and deliver superior care and outcomes” (Blue Wolf, 2019). They focus on transformation of companies strategically, operationally, and collaboratively to significantly reduce or eliminate fragmentation of services in their portfolio of companies.

Venture Capital

Like PE firms, venture capital has taken notice to the investment opportunities and market inefficiencies in I/DD and autism. Current products and services in the market are now seeing new and innovative market disruptors transforming “inadequate” offerings in the sector. And with the rise of “impact investing” more VC investors are looking towards the market through a different lens – expanding opportunities in support of mission-driven organizations. Recently, a venture capitalist, Brian Jacobs, started Moai Capital to invest in startups who are innovating to help increase employment for autistic adults and to create “autism-friendly workplaces” in for-profit companies. While Moai is not focused on VC investment in non-profit organizations, it is investing in quality of life measures and expecting lower-than-average returns. Other areas of VC investment impacting the I/DD space include – housing, social interaction, and technology.

Kadiant + TPG Capital Partners and Viola Ventures, a new autism services company, was created by Lani Fritts, the co-founder of Trumpet Behavioral Health and founding board member of The Council for Autism Service Providers (CASP). The new mission-driven organization will be focused on improving services in the autism market by partnering with existing providers, integrating them into a common organization, and expanding access by opening new locations (TPG, 2019). TPG Capital Partners committed $300 million of equity capital to drive Kadiant’s launch and growth strategies. Vida Ventures will also invest in the Kadiant platform and contribute to the organization’s clinical- and business-building capacity.

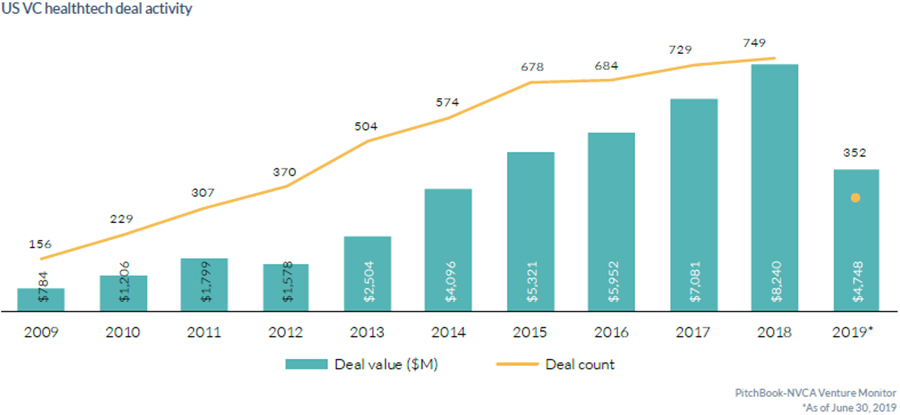

Trends in VC deals in health care technology are looking toward a record-breaking year (Figure 3) (Mathur, 2019). Tech companies focused on data analytics, AI-powered software, and care treatment platforms are driving VC investments to improve the I/DD space.

Figure 3. US VC Deal Trends. Pitchbook. 2019.

One of Modern Healthcare’s 2015 Top 25 Innovators, StationMD (https://www.stationmd.com/), received a small amount of VC funding in March 2019 to create an emergency medicine telehealth platform. The founder, Dr. Matthew Kaufman, an emergency medicine physician, founded StationMD after seeing many patients with I/DD being sent to the emergency room (ER) for non-emergency cases. The platform allows patients in nursing homes, group homes, and other residential facilities to be seen by physicians while staying in their community and out of the ER. Agencies using StationMD have seen an 85% drop in ER transfers and millions in cost savings (Modern Healthcare, 2019).

Technology Advancements for Care & Sustainability

The gaps in capacity, care coordination, diagnosis, self-management, and improvement in the I/DD population have created an optimal environment for the entrance of technology and tech advancements for care and sustainability of services. Applying technology to care coordination and the care delivery process can improve efficiencies and increase the amount of data collected on services and care outcomes. In addition, technology in this space has become a ‘workforce extension’ providing individuals with in-home behavioral supports, companion tools, and physical assistance robots.

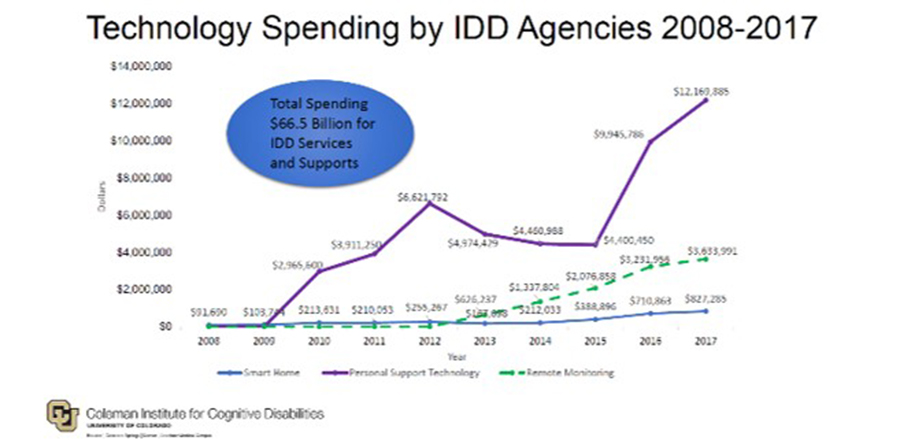

State departments are welcoming the adoption of technology by becoming Technology First state for individuals with I/DD (including Alaska, Delaware, Indiana, New York, Missouri, Ohio, Pennsylvania, Tennessee, and Wisconsin). Being a Technology First state means they design initiatives to expand access to technology for individuals with I/DD and to ensure technology is considered as part of all supports and services. A study by the Coleman Institute for Cognitive Disabilities at the University of Colorado on state expenditure for technology solutions found a huge increase in spending on technology-based services and supports since 2015 (Figure 4) (Coleman Institute for Cognitive Disabilities, 2018). This investment aligns with the shift to consumer-directed, home-based care, that improves the quality of life and independence for individuals.

Figure 4. Technology Spending in I/DD Supports and Services 2008-2017.

Coleman Institute for Cognitive Disabilities. 2018.

The tech trend in I/DD is not looking to lag any time soon. Emerging technologies with the development of artificial intelligence (AI) platforms, smart homes and remote monitoring, and user-friendly hardware will continue to drive the adoption of technology in the I/DD market.

Operating with New Competition

Pressure on the health care system to decrease costs and increase quality has opened the door to outside competition to close the gaps, create efficiencies of scale, and drive innovation in a historically fragmented industry. In the I/DD market, provider executives must evaluate options to create a sustainable strategy in-house to remain competitive.

M&A, PE and VC, and tech organizations are changing the sustainability of traditional provider organizations—with new service offerings, investment capital for technology and scale, pressure on contracts and fee structures, and the ability to accept value-based reimbursement.

Given the high capital needs of the market, these competitors have a capital edge on many providers but are willing to create partnerships and arrangements to help advance mission-based organizations and expand services to create sustainability.

Operating in a fee-for-service, small, siloed niche will soon become an anomaly and with the mounting popularity of managed care (See How Can Managed Care Work…), the I/DD environment will not look the same in the near future. It is important to be creative when developing competitive strategies, be open to change and the possibility of business model shifts (See The I/DD Provider Business Model Must Shift…) and be excited to improve the quality and care provided to compete (See Moving From Utilization To Value…).

References

Alternative Behavior Strategies. 2019, August 19. Alternative Behavior Strategies Receives Funding from Morgan Stanley Expansion Capital [Press Release]. Retrieved from https://www.businesswire.com

Beltran, L. 2019, August 5. Formation Capital, Safanad exit RHA Health Services. The PE HUB Network. Retrieved from https://www.pehub.com

Blue Sprig Pediatrics, Inc. 2019, June 18. Blue Sprig Pediatrics Announces Acquisition Of Verbal Behavior Consulting [Press Release]. Retrieved from https://www.prnewswire.com

Blue Sprig Pediatrics, Inc. (n.d.). Grow With Us. https://bluesprigautism.com

Blue Wolf Capital Partners. 2019, Aug 5. Blue Wolf Capital Acquires RHA Health Services [Press Release]. Retrieved from https://www.businesswire.com/

Coleman Institute for Cognitive Disabilities. 2018. Consider Technology First: Technology Across the U.S. Presented at NASDDDS Directors Forum & Mid-Year Conference, June 7 2018. Retrieved from https://www.nasddds.org

Kogan, M. D., Vladutiu, C. J., Schieve, L. A., Ghandour, R. M., Blumberg, S. J., Zablotsky, B., … & Lu, M. C. (2018). The prevalence of parent-reported autism spectrum disorder among US children. Pediatrics, 142(6), e20174161. Retrieved from https://pediatrics.aappublications.org

Mathur, P. 209, July 24. 21 charts showing current trends in US venture capital. PitchBook. Retrieved from http://bit.ly/2lFbjlS

Modern Healthcare. 2019. Top 25 Innovators – Dr. Matthew Kaufman. Retrieved from http://bit.ly/2kbloGP

Oss, M. 2019, January 24. Watch Out For Elephants [Executive Briefing]. OPEN MINDS Circle. Retrieved from https://www.openminds.com

TPG Capital. 2019, Feb. 1. TPG Capital and Lani Fritts Partner to Launch Kadiant [Press Release]. Retrieved from https://www.businesswire.com

Xu, G., Strathearn, L., Liu, B., O’brien, M., Kopelman, T. G., Zhu, J., … & Bao, W. (2019). Prevalence and treatment patterns of autism spectrum disorder in the United States, 2016. JAMA pediatrics, 173(2), 153-159. https://jamanetwork.com